Why IOTA's Bold Trade Focus Could Redefine Staking Returns

IOTA's $35T trade integration plan isn't just hype. Discover how it could unlock new staking rewards and reshape your portfolio strategy.

Could IOTA Make Your Staking Rewards Soar?

What if solving a $35 trillion inefficiency could directly benefit your staking portfolio? That’s exactly the opportunity IOTA is tackling as it repositions itself away from speculative crypto cycles to become the backbone of global trade infrastructure. If you’re holding or staking IOTA, the next few years could be transformative.

Here’s how—and why—you should care.

IOTA’s Blue Ocean: $35 Trillion in Global Trade

Instead of competing in saturated crypto niches like NFTs or DeFi yield farming, IOTA is carving out its own "Blue Ocean" strategy: the untapped, trillion-dollar global trade and logistics market. This bold move is aimed at digitizing and tokenizing real-world assets, from trade documents to physical goods, solving inefficiencies that cost businesses billions annually.

Consider this: over 4 billion trade documents are in circulation daily, involving multiple parties and endless paperwork. The result? Cross-border trade overheads reaching 20% due to delays, errors, and compliance red tape. By leveraging blockchain technology, IOTA’s solutions like the Trade Worldwide Information Network (TWIN) promise to reduce weeks-long document processing to mere days.

For stakers, this means greater demand for IOTA tokens as they become essential for enabling trade-related transactions. As adoption scales, so too could staking rewards. Use this APY Calculator to explore how increased network activity might impact your returns over time.

What This Means for Your Staking Rewards

At its core, IOTA isn’t just digitizing trade for the sake of innovation—it’s creating a self-sustaining ecosystem. Here’s why that’s bullish for stakers:

Increased Token Utility: As businesses tokenize trade documents and assets on IOTA’s network, the demand for IOTA tokens will rise. Increased transaction volume directly correlates to higher staking rewards.

Network Effects: Partnerships with heavyweights like the World Economic Forum (WEF) and Global Alliance for Trade Facilitation ensure that IOTA’s infrastructure has buy-in from major players. More countries adopting IOTA for trade creates a flywheel effect—one that could amplify staking yields as the network scales globally.

Real-World Adoption, Real Rewards: Unlike speculative blockchain projects, IOTA is already processing real transactions in Kenya, the UK, and beyond. As these use cases grow, so does the volume of staking output. Curious how compounding these rewards might look in the long term? Run some numbers on this compounding calculator.

Why IOTA’s Strategy Stands Out

Many blockchain networks promise adoption, but few deliver. What sets IOTA apart is its laser focus on vertical integration. By embedding itself into every layer of trade—from digital identities to tokenized trade finance—IOTA isn’t just solving problems; it’s making itself indispensable.

Here’s where IOTA’s approach diverges from the pack:

Non-Speculative Growth: Unlike projects that rely on hype cycles, IOTA is building a neutral, open-source infrastructure. This non-profit model fosters trust among governments, enterprises, and regulators—critical players for global trade.

Legal Readiness: The Model Law on Electronic Transferable Records (MLETR) gives IOTA’s tokenized documents the same legal status as physical ones in many jurisdictions. This regulatory clarity accelerates adoption, creating a framework for real-world use.

AI and Blockchain Synergy: By combining blockchain’s trust with AI’s intelligence, IOTA positions itself as the “brain and nervous system” of the digital trade economy. This dual focus aligns with broader tech trends that stakers should watch closely.

How to Capitalize on IOTA’s Momentum

Stakers, here’s what you should do to prepare:

Stake Smart: As global trade adoption scales, network activity could surge. Stay ahead by tracking validator performance using the Staking Tracker.

Think Long-Term: The real adoption curve for IOTA’s trade solutions is just beginning. Lock in tokens now to maximize compounding rewards as adoption grows.

Stay Informed: Partnerships with organizations like the CIOE&IT and WEF add credibility, but they also signal where the network may expand next. Keeping an eye on these developments could give you an edge.

Final Thoughts: Is IOTA the Trust Layer of Tomorrow?

While the blockchain landscape is riddled with failed promises, IOTA’s focus on solving real-world problems gives it a unique edge. The project isn’t just about creating another blockchain—it’s about building the digital infrastructure for a connected and efficient global economy.

For stakers, the implications are clear: as IOTA becomes a critical player in trade and logistics, the demand for its token will only grow, driving up staking rewards. The time to position yourself isn’t years from now—it’s today.

The world is moving onchain. Will your portfolio be ready when it does?

Source: IOTA Foundation Blog

Written by IOTA Staking Team

Expert in IOTA staking, blockchain technology, and DeFi strategies. Providing actionable insights to help you maximize your staking rewards.

Related Articles

IOTA at 10: The Decade-Long Bet on Bringing the Real World Onchain

After a decade of building, IOTA is emerging as the blockchain backbone for global trade. Here's how $33 trillion in commerce is going digital.

An Open Letter from an IOTA OG: We Didn't Just Survive – We Won

A retrospective on holding IOTA from 2017 to today, the transition to real-world adoption, and why staking is the victory lap.

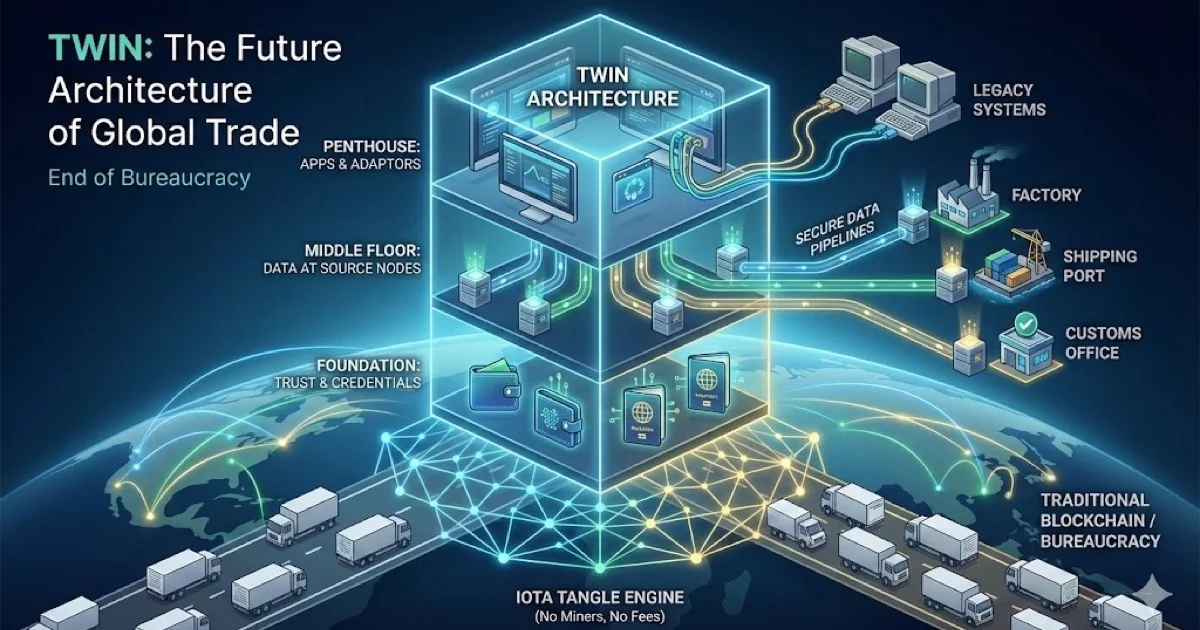

Is This the End of Global Trade Bureaucracy? Deconstructing TWIN

TWIN proposes a Digital Public Infrastructure to revolutionize global supply chains. Here's how it works across three architectural levels—from apps to data services to trust framework.