Understanding IOTA Staking Rewards

A comprehensive guide to how IOTA staking rewards work, APY calculations, and maximizing your returns.

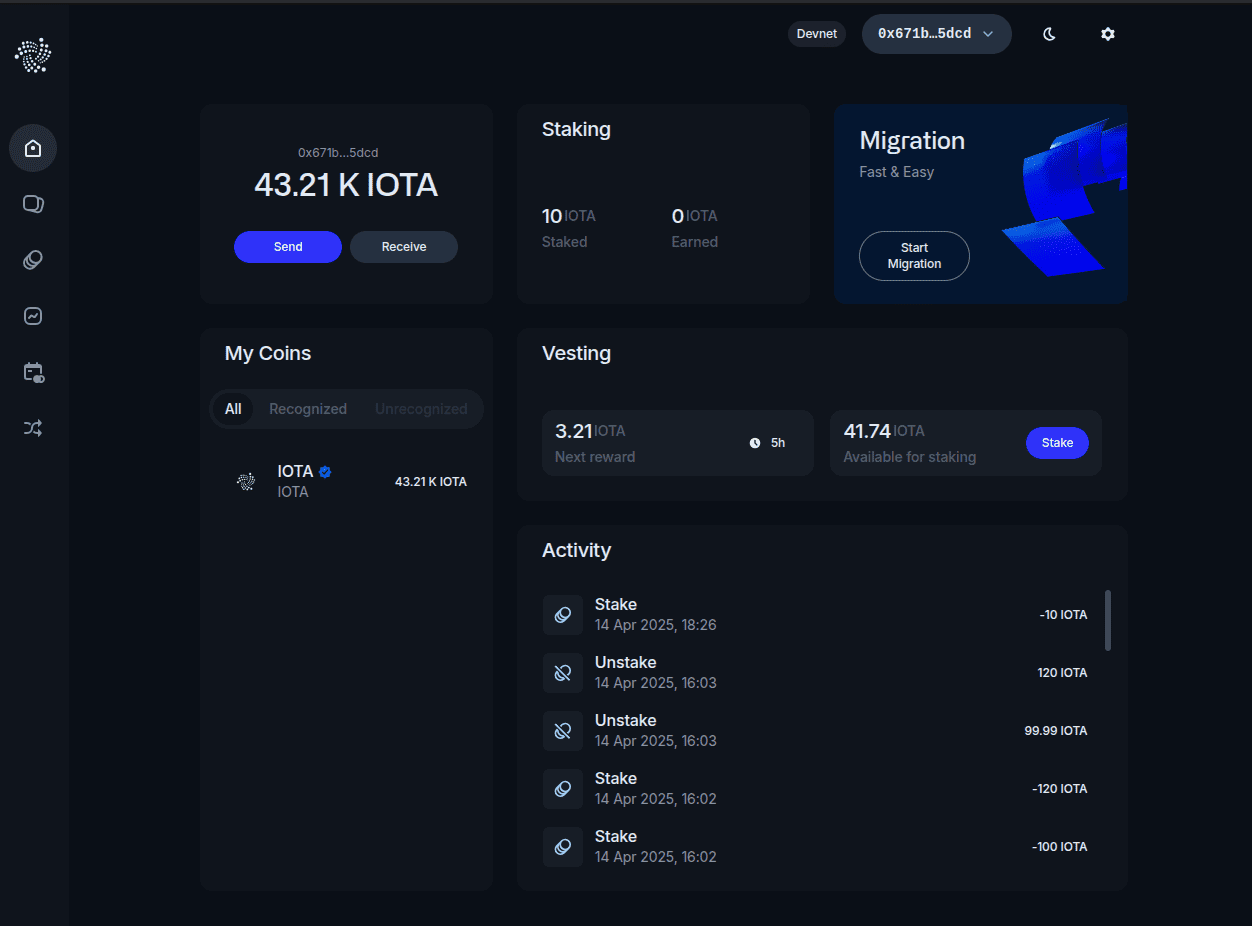

How IOTA Staking Works

You delegate IOTA to validators. Validators secure the network and earn protocol rewards. Rewards are shared to delegators after validator commission.

Understanding APY

APY is total return over a year including compounding. On IOTA, staking rewards compound automatically at the pool/exchange-rate level each epoch—no manual restake.

Factors Affecting Your APY

- Validator performance/uptime

- Validator commission (varies; verify in explorer/wallet)

- Your stake share in the validator and time staked

- Protocol reward rate and epoch cadence

Maximizing Your Returns

Choose Quality Validators

Seek:

- High, consistent uptime

- Transparent, reasonable commission

- Proven performance history

- Constructive governance participation

Understand Compounding

Rewards auto-compound. Use our Compounding Calculator to simulate epoch compounding effects on long-term returns.

Diversify Your Stake

Avoid a single validator. Spreading stake:

- Reduces validator risk

- Improves decentralization

- Can smooth returns across pools

Track Your Performance

Monitor via the Staking Tracker. Cross-check validator metrics in your wallet or explorer.

Notes

Displayed APY is indicative, not guaranteed. Actual returns depend on validator commission, performance, stake share, and protocol parameters.

Conclusion

Know how rewards accrue, pick strong validators, rely on auto-compounding, diversify, and monitor results.

Written by IOTA Staking Team

Expert in IOTA staking, blockchain technology, and DeFi strategies. Providing actionable insights to help you maximize your staking rewards.

Related Articles

IOTA Pays 6x More Than Ethereum Staking. Here's How Much You Need for $100/Month

At 11% APY, about 116,000 IOTA (~$10,900). We break down the math, compare it to ETH and SOL, and show what happens if IOTA returns to $0.25.

7 Common IOTA Staking Mistakes That Are Costing You Money (And How to Fix Them)

Avoid these critical IOTA staking mistakes that reduce your rewards. Learn how to optimize your validator selection, manage commission fees, and maximize your APY returns.

How Long to Build $1M Staking IOTA? The Math at Every Price

$500/month at 11% APY builds a $1M portfolio in 28 years—and by Year 15, rewards exceed contributions. Full timeline at every price.