Salus: How IOTA Is Tokenizing Critical Minerals and Transforming Trade Finance

Salus tokenizes commodity inspection certificates as NFTs on IOTA, enabling transparent trade finance for critical minerals from Africa and Latin America.

Introduction

While IOTA holders track staking rewards with tools like the APY Calculator, something far bigger is happening behind the scenes: real commodities worth hundreds of thousands of dollars are now moving on-chain. Salus, a Singapore-based trade finance platform, has brought critical minerals from African mines onto the IOTA blockchain—and it's not a testnet experiment. It's live.

This is what real-world adoption looks like: not hype, but half a ton of tantalum tokenized as an NFT, changing hands between suppliers, funders, and buyers with full on-chain transparency.

🌍 What Is Salus?

Salus is a digital trade finance platform that launched in September 2025 with a clear mission: bridging the $2.5 trillion global trade finance gap that leaves small and medium-sized suppliers in emerging markets unable to access funding. The platform focuses specifically on critical minerals—tantalum, tin, niobium, copper, lithium, and rare earth elements—connecting verified suppliers (primarily smaller producers in Africa and Latin America) with institutional and decentralized funders.

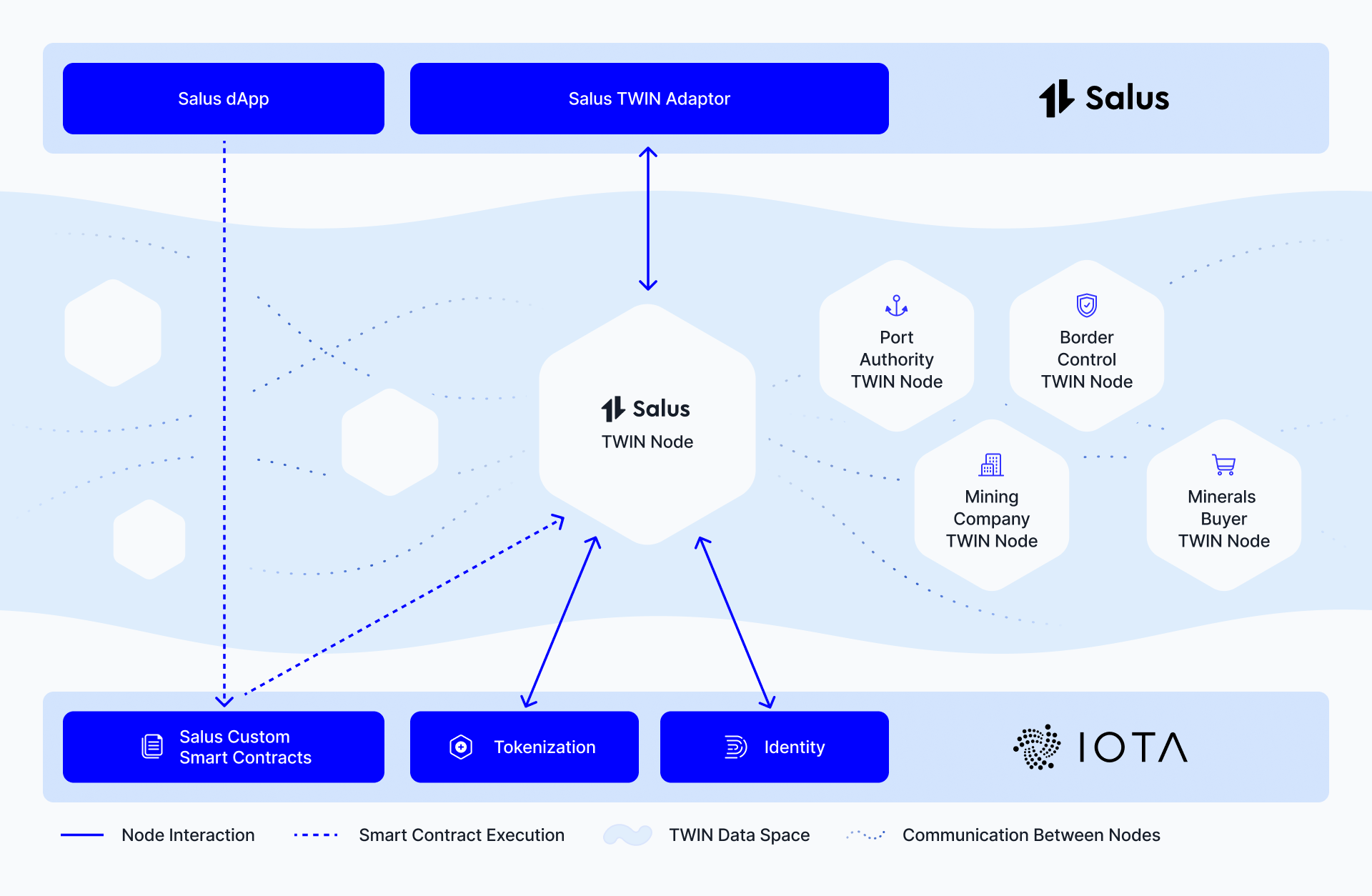

Built natively on the IOTA blockchain, Salus tokenizes physical shipments and trade documents as NFTs, creating transparent, verifiable records of commodity ownership and enabling faster, more efficient financing workflows. The platform leverages IOTA's TWIN (Trade Worldwide Information Network) infrastructure for its underlying architecture.

💰 The Problem Salus Solves

Traditional trade finance suffers from slow, paper-based processes that can take weeks to resolve. For SMEs and emerging market suppliers, accessing bank financing has historically been difficult due to high perceived risk and a lack of verifiable documentation. Salus addresses these challenges by digitizing and verifying trades in real-time, enabling faster funding for suppliers and transparent, asset-backed yield for investors.

If you've read our deep dive on TWIN (Trade Worldwide Information Network), you'll recognize the infrastructure Salus builds upon. While TWIN provides the decentralized rails, Salus is one of the first platforms actually moving real value across them.

The platform builds on licensed processes proven in over $4 billion of real-world trades from TradeFlow Capital Management, a predecessor commodity trade finance firm. Key team members, including co-founder Trevor Skidmore (former Rio Tinto executive), bring substantial experience in the critical minerals sector.

⚙️ How Salus Works: The Technical Implementation

According to Salus's own technical documentation, the platform tokenizes commodity inspection certificates—called Digital Warehouse Receipts (DWRs)—as NFTs on IOTA. Each NFT anchors a document hash on-chain and tracks ownership as materials move through financing cycles.

The Core Workflow

Step 1: Tokenization

When a material batch inspection completes and arrives at a warehouse:

- A DWR PDF is generated containing immutable asset certification with assay results, weights, and origin

- A cryptographic hash (

digestSRI) is computed using SHA-384 - An NFT is minted with the hash stored in immutable metadata

- The NFT is transferred from the system wallet to the supplier's wallet

- An initial Status Certificate is archived

Step 2: Financing

When a supplier offers material to a funder and payment is confirmed:

- The NFT transfers from the supplier's wallet to the funder's wallet

- The transfer timestamp is recorded on-chain

- A Status Certificate is archived documenting the title transfer

Step 3: Settlement

When the supplier repays the funder:

- The NFT transfers back from funder to supplier

- The transfer timestamp is recorded

- A Status Certificate is archived

- The financing transaction closes

The complete flow looks like this:

[System Wallet] --mint+transfer--> [Supplier] --finance--> [Funder] --settle--> [Supplier]Metadata Structure

Salus stores JSON-LD in immutable NFT metadata following schema.org's DigitalDocument standard:

{

"@context": ["https://schema.org", "https://www.w3.org/ns/credentials/v2"],

"@type": "DigitalDocument",

"@id": "https://nexus.salusplatform.com/parcel/{uuid}",

"contentUrl": "https://nexus.salusplatform.com/dwr/{uuid}",

"encodingFormat": "application/pdf",

"digestSRI": "sha384-{base64_encoded_sha384_hash}",

"dateCreated": "2025-01-16T10:30:00Z",

"publisher": { "@type": "Organization", "name": "Salus Platform" },

"material": "Metal",

"form_type": "Concentrate"

}Anyone can download the PDF from the contentUrl, compute the hash, and verify it matches the on-chain value—creating trustless verification of document authenticity.

NFT ID Format

Salus uses a standardized NFT identification format:

nft:iota:{network}:{address}:{objectId}🔐 Three-Layer Verification System

Salus implements a sophisticated verification package that solves a fundamental problem: how do you prove both "what the asset is" and "who owns it now" when these answers come from different sources?

| File | Proves | Source of Truth |

|---|---|---|

| DWR PDF | Asset attributes (weight, assay, origin) at tokenization | Blockchain (hash in NFT metadata) |

| Status Certificate PDF | Current ownership and transfer history | Platform records + blockchain transfers |

| attestation.json | Links both documents with verification data | Machine-readable bridge |

The DWR is frozen at minting (hash locked on-chain), but ownership changes. Rather than updating the DWR and breaking blockchain verification, Salus uses three files that work together:

- DWR - Immutable proof of "what" (verifiable against blockchain)

- Status Certificate - Current proof of "who" (signed by platform)

- attestation.json - Ties them together with hashes, signatures, and explorer links

Verification Methods

External parties can verify documents through multiple channels:

- Client-side hash verification: Browser computes SHA-384 of PDF and compares to

content_hashin attestation.json - Server-side signature verification: POST file to

/verify/file/signatureendpoint, which validates HMAC-SHA256 with timestamp anti-replay - Blockchain verification: Navigate to the IOTA explorer URL, locate

digestSRIin NFT immutable metadata, and compare to computed hash

📈 Real-World Impact: First Transactions

In September 2025, Salus announced its first on-chain transaction—approximately half a ton of tantalum worth about $350,000 brought on-chain. The trade involved a Singapore hedge fund and a US buyer, with the tantalum sourced from Rwanda.

The platform is currently operational in Rwanda and expanding across Africa and Latin America. Salus has set ambitious targets: $100 million in trade volume by end of 2025 and $1 billion in 2026.

🔗 Integration with IOTA's TWIN Infrastructure

Salus is categorized as a Layer-2 "Platform Builder" partner on TWIN, building a tokenization product on top of TWIN infrastructure. The platform uses:

- Wallet creation - One wallet per company (supplier or funder)

- NFT minting - Immutable JSON-LD metadata containing document hashes

- NFT transfers - Ownership changes during financing lifecycle

- NFT burns - For error correction (rare)

- Metadata retrieval - For verification requests

The integration wraps IOTA SDK calls in a Node.js service that the Salus PHP application calls via API endpoints for minting, transferring, and retrieving NFT metadata.

🚧 What Salus Isn't Using (Yet)

According to Salus's technical documentation, several IOTA features exist but haven't been implemented yet:

| Feature | Current State | Potential Future Use |

|---|---|---|

| DIDs/Identity | Just wallet addresses | Company identities as DIDs, verifiable credentials |

| Smart Contracts/Move | No on-chain logic | Escrow for financing, automatic settlement triggers |

| Native Tokens | Only NFTs | Fungible tokens representing commodity value |

| Streams/Channels | Not using | Audit trail streaming, event notifications |

This represents significant room for deeper IOTA integration as the platform matures.

👥 For Suppliers and Funders

For Suppliers: List trades digitally, generate secure records of goods without extra steps, sign clear contracts on-platform, and receive funding in days via streamlined workflows.

For Funders: Access verified, insured cargoes with live tracking, AI-driven risk checks, automated contracting, and on-chain verification for auditability and enforceability.

🚀 Conclusion

Salus represents one of the most concrete examples of IOTA's real-world adoption for tokenized real-world assets (RWAs) in trade finance. By tokenizing commodity inspection certificates as NFTs and enabling transparent ownership tracking through financing cycles, the platform demonstrates how blockchain technology can address genuine market inefficiencies.

The $2.5 trillion trade finance gap is a real problem affecting millions of small producers globally. With its first transactions already complete and expansion underway, Salus is no longer a theoretical use case but an operational platform processing real value on the IOTA network.

For IOTA stakers, platforms like Salus represent the kind of real-world utility that drives long-term network value. While you track your staking rewards with the Staking Tracker or model compound growth with the Compounding Calculator, know that the network you're supporting is actively powering global trade finance infrastructure.

Sources

- Salus Platform Website - Official platform for suppliers and funders

- IOTA Foundation Blog - Salus Launch - Official announcement of September 2025 launch

Disclaimer: This article is for educational and informational purposes only. The information about Salus is based on publicly available documentation and announcements. Always do your own research before engaging with any trade finance platform or DeFi protocol.

Tagged with:

Written by IOTA Staking Team

Expert in IOTA staking, blockchain technology, and DeFi strategies. Providing actionable insights to help you maximize your staking rewards.

Related Articles

IOTA at 10: The Decade-Long Bet on Bringing the Real World Onchain

After a decade of building, IOTA is emerging as the blockchain backbone for global trade. Here's how $33 trillion in commerce is going digital.

IOTA Staking Weekly - Feb 9, 2026

Feb 9, 2026: IOTA staking at 11% APY with 51% of supply locked. Total stake grew 0.88% this week, price down 7.58%.

IOTA Staking Weekly - Feb 2, 2026

Feb 2, 2026: IOTA staking at 11% APY with 50% of supply locked. 73 validators, Nakamoto coefficient 7.