IOTA trust framework and stablecoins spark staking hype

IOTA's new trust framework, stablecoin tests on Testnet, and global hackathons are setting up fresh opportunities for IOTA stakers.

Introduction

The IOTA ecosystem just wrapped up one of its most intense weeks in recent memory. A new IOTA Trust Framework for verified digital assets, visible stablecoin tests on the IOTA Testnet, and high-profile hackathons and events are all hitting at once — and the community is buzzing.

You can feel that buzz in viral posts like the now-famous "#SwingAway" clip shared by @Salimasbegum, congratulating the team on how far #IOTA has come and hinting that the next swing could be a big one.

As a staker, this matters directly to you. More real-world assets, regulated stablecoins, and dApps can translate into more activity on the network — and potentially better rewards. Use our APY Calculator to get a feel for how higher usage might affect your expected returns, then keep an eye on your positions with the Staking Tracker.

IOTA's industry-agnostic trust framework, in plain language

IOTA has introduced a modular Trust Framework designed to make digital trust and asset verification easier for real-world businesses, not just crypto-native projects. The framework is built around five core components:

IOTA Identity – Verifiable digital identities for people, organizations, and devices.

IOTA Hierarchies – Structured access control for complex organizations.

IOTA Notarization – Proof of origin and timestamps for data and documents.

IOTA Gas Station – Sponsored transactions so end users can interact without holding tokens.

IOTA Tokenization – Issuing and managing tokenized real-world assets (RWAs) with policy and compliance rules.

According to IOTA's own announcement and coverage by major outlets, the Trust Framework is open-source, modular, and tightly integrated with the IOTA mainnet. It's meant to be plug-and-play for use cases like:

Tokenized invoices and trade finance

Supply-chain tracking and product passports

Circular economy assets and carbon credits

Regulated RWAs that require identity and audit trails

For stakers, this matters because every new asset, workflow, or integration built on this stack ultimately runs on IOTA infrastructure. If the framework lowers friction for enterprises to come on-chain, it increases the chances that IOTA becomes the preferred settlement and data layer for entire industries.

Before you go deeper, you can use the APY Calculator to model how higher long-term usage could affect your staking strategy if token demand grows over time.

Stablecoin tests on IOTA Testnet: why MYRC, JPYC and XSGD matter

Alongside the Trust Framework news, on-chain watchers noticed something else: regulated Asian stablecoins moving on the IOTA Testnet, including:

MYRC – Malaysian ringgit-pegged stablecoin

JPYC – Japanese yen-pegged stablecoin

XSGD – Singapore dollar-pegged stablecoin

Community analysts like @ApexSeek and others shared screenshots of these tokens transacting on IOTA's Testnet and speculated about a broader strategy around Asian digital currencies and real-world trade.

If these stablecoins progress from testing to mainnet deployment, several things could happen:

IOTA becomes a multi-currency settlement layer for cross-border payments, especially in the Asia-Pacific region.

DeFi protocols on IOTA can build with regulated fiat rails instead of purely volatile tokens.

Liquidity pools, lending markets, and payment rails using these stablecoins drive more on-chain activity.

From a staking perspective, this is powerful:

More transactions → more demand for safe, performant infrastructure.

More TVL (total value locked) in DeFi → more projects that need long-term, aligned validators and delegators.

More institutional attention → more regulatory focus, but also more potential capital.

If you're planning to stake through the next few years, it's worth running scenarios in the Compounding Calculator to see how long-term, steady rewards could play out if network usage ramps up.

MOVEATHON Europe and BuildSphere: the dApp pipeline

Network upgrades and stablecoin tests are only half the story. IOTA is also investing heavily in developer momentum:

MOVEATHON Europe is a major hackathon focused on building practical dApps on IOTA's MOVE-based Layer 1, with a prize pool reported at over $150,000 (CoinMarketCap coverage). Tracks include DeFi, digital identity, supply chain, and more.

The BuildSphere series has featured live demos of tools like IOTA Playground, giving developers an easier way to test and ship MOVE smart contracts (IOTA Blog).

Why should stakers care?

Hackathons are where the next wave of dApps is born — some will need their own staking mechanics, reward tokens, or governance systems on top of IOTA.

Tools like IOTA Playground lower the barrier to entry, increasing the number of teams who can experiment with DeFi, RWAs, and payments on the network.

As more serious projects choose IOTA as their base layer, they contribute to long-term demand for secure validation and robust staking infrastructure.

If you're staking already, these events are a signal that your role as a network participant is becoming more important, not less.

Digital identities, TWIN and GLEIF: trusted rails for global trade

Another key part of the story is IOTA's work on digital identities and trade infrastructure, which ties directly into the Trust Framework:

IOTA has signed a Memorandum of Understanding (MoU) with the Global Legal Entity Identifier Foundation (GLEIF) to bring verifiable Legal Entity Identifiers (LEIs and vLEIs) on-chain (IOTA Blog).

This work plugs into IOTA's Trade Worldwide Information Network (TWIN), a decentralized trade infrastructure for real-time, cross-border data sharing.

The goal is to make it easy for customs, logistics providers, banks, and corporates to:

Prove who is involved in a transaction (verified organizational identities).

Prove what is being traded (tokenized goods, invoices, and documents).

Prove that the process followed agreed rules (policy-aware tokenization and notarization).

For staking, this type of partnership is a strong signal that IOTA is aiming for serious, regulated use cases, not just speculative flows. If TWIN and GLEIF-backed identities become a standard rail for global trade, the underlying network — and its validators — become a critical piece of infrastructure.

What this all means for your IOTA staking strategy

Putting it together:

The Trust Framework makes it easier for enterprises to build compliant, tokenized workflows on IOTA.

Stablecoin tests hint at a future where IOTA underpins multi-currency payments and DeFi in key regions like Asia.

Hackathons and events like MOVEATHON Europe and BuildSphere are actively seeding the next generation of IOTA-native dApps.

Identity and trade partnerships (TWIN, GLEIF) point toward high-value, real-world adoption rather than purely speculative activity.

As a staker, you don't need to chase every new announcement, but you should:

Model your returns.

Use the APY Calculator to check how different reward rates and time horizons would affect your portfolio.

Monitor network momentum.

Keep an eye on your positions and validator performance with the Staking Tracker, especially as new dApps and stablecoins launch.

Think long-term compounding.

Run "what if" scenarios in the Compounding Calculator to understand how consistent rewards over multiple years compare to short-term speculation.

Stay informed about risks.

New RWAs and stablecoins also mean regulatory and technical risk. When in doubt, check the FAQ for staking basics, slashing concerns, and best practices.

The feeling in the community — captured well by the "#SwingAway" meme — is that IOTA has stepped up to the plate with a more complete story: infrastructure, identity, assets, and real-world partners. As a staker, your job is to decide how much exposure you want to that story and for how long.

Sources

Official announcements and news

- IOTA Trust Framework – IOTA Blog (October 7, 2025)

- IOTA Trust Framework announcement – Kucoin News

- Q3 2025 Progress Update – IOTA Blog (October 9, 2025)

- Bringing Trusted Digital Identities to Global Trade – IOTA Blog (September 16, 2025)

- MOVEATHON Europe hackathon details – CoinMarketCap News

- BuildSphere and IOTA Playground coverage – IOTA Blog

Social posts and community discussions

Tagged with:

Written by IOTA Staking Team

Expert in IOTA staking, blockchain technology, and DeFi strategies. Providing actionable insights to help you maximize your staking rewards.

Related Articles

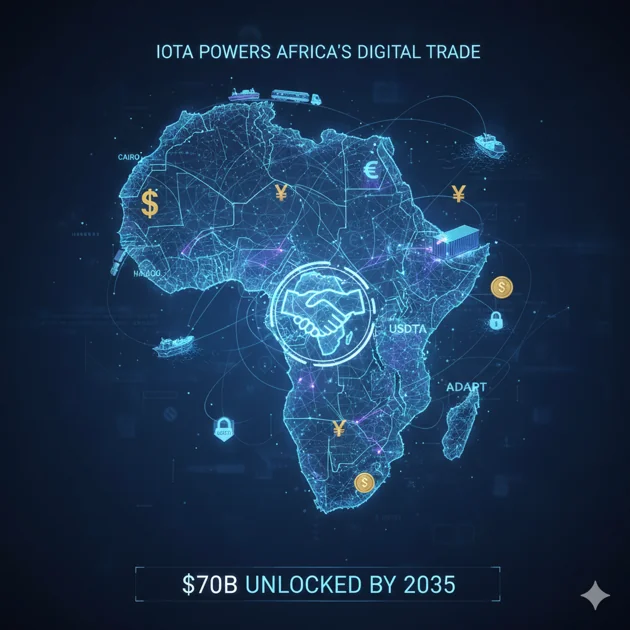

IOTA Powers Africa's $70B Digital Trade Revolution

IOTA is building digital infrastructure for AfCFTA using stablecoins and decentralized identities to unlock $70B in intra-African trade by 2035.

IOTA Powers UK Trade Testbed with Real-World Use

IOTA's tech is now driving UK trade pilots, with live transactions set to hit the mainnet. Big implications for staking and adoption.

Why IOTA's Hackathon Could Shape Europe’s Web3 Future

Learn how IOTA's 2026 hackathon unlocks real-world Web3 skills and career opportunities. Here's why it matters for builders and stakers.