IOTA at 10: The Decade-Long Bet on Bringing the Real World Onchain

After a decade of building, IOTA is emerging as the blockchain backbone for global trade. Here's how $33 trillion in commerce is going digital.

A decade in the making

Ten years is an eternity in crypto. Projects launch, moon, and vanish within months. Yet here we are in 2025, watching IOTA celebrate its tenth anniversary—not with another rebrand or pivot, but with governments and enterprises actually deploying its technology at scale.

The vision hasn't changed since 2015: become the infrastructure layer where the real world operates onchain. What's changed is that the world is finally ready.

If you've been staking through the cycles, you've watched this unfold. Use our APY Calculator to see what those years of patient accumulation have built—and what the next decade might look like as adoption accelerates.

Why blockchain matters more than ever

We're living through three parallel technology revolutions. Cloud computing digitized our data—a $723 billion annual market still growing at 20%. Artificial intelligence is reshaping how we think and create—the industry now exceeds $750 billion. And blockchain? It's establishing the trust layer that both of these need to function in a connected global economy.

Here's the insight that matters: AI generates; blockchain verifies. As synthetic content and automated transactions become ubiquitous, the ability to authenticate data, prove ownership, and execute agreements without intermediaries becomes essential infrastructure—not optional tooling.

The cloud giants (AWS, Google, Azure) captured massive value by being early. The AI leaders (OpenAI, Anthropic, Google) are doing the same. The blockchain networks that emerge as critical infrastructure for real economic activity will follow the same trajectory.

The question isn't whether this happens. It's which networks capture the value.

The blue ocean strategy

Most blockchain projects compete for the same users. DeFi degens. NFT collectors. Memecoin traders. It's a red ocean—bloody competition for a limited pool of crypto-native capital.

IOTA made a different bet: ignore the competition entirely. Instead of fighting for existing crypto users, build infrastructure that brings entirely new economic activity onchain.

The target? Global trade.

International commerce in goods and services exceeded $32 trillion in 2024—roughly one-third of global GDP. Every country participates. Millions of companies. Billions of consumers. Yet the systems moving these goods are shockingly archaic.

Consider what happens today:

- 4 billion trade documents circulate globally at any moment

- Each shipment involves up to 30 entities exchanging 36+ documents with 240 copies

- Cross-border overhead adds 20%+ costs through paperwork, compliance, and delays

- Banks lose $2-5 billion annually to forged or duplicate trade documents

- A $2.5 trillion financing gap leaves reputable traders without capital

Trade in 2025 still depends on pieces of paper being physically shipped around the world. DHL was literally founded in 1969 to solve this problem by moving documents faster. We're still doing it.

The regulatory breakthrough nobody noticed

Since 2017, a growing number of countries have adopted the Model Law on Electronic Transferable Records (MLETR). This gives electronic documents—bills of lading, warehouse receipts, promissory notes—the same legal standing as physical paper.

The legal foundation exists. The challenge was always adoption and integration. No single government can mandate a global solution. Previous attempts (remember IBM and Maersk's TradeLens?) failed because they were proprietary platforms run by competitors. Who joins their rival's private blockchain?

The solution requires neutral, open-source infrastructure that participants adopt because it benefits them—not because someone forces them by authority.

This is precisely what IOTA built.

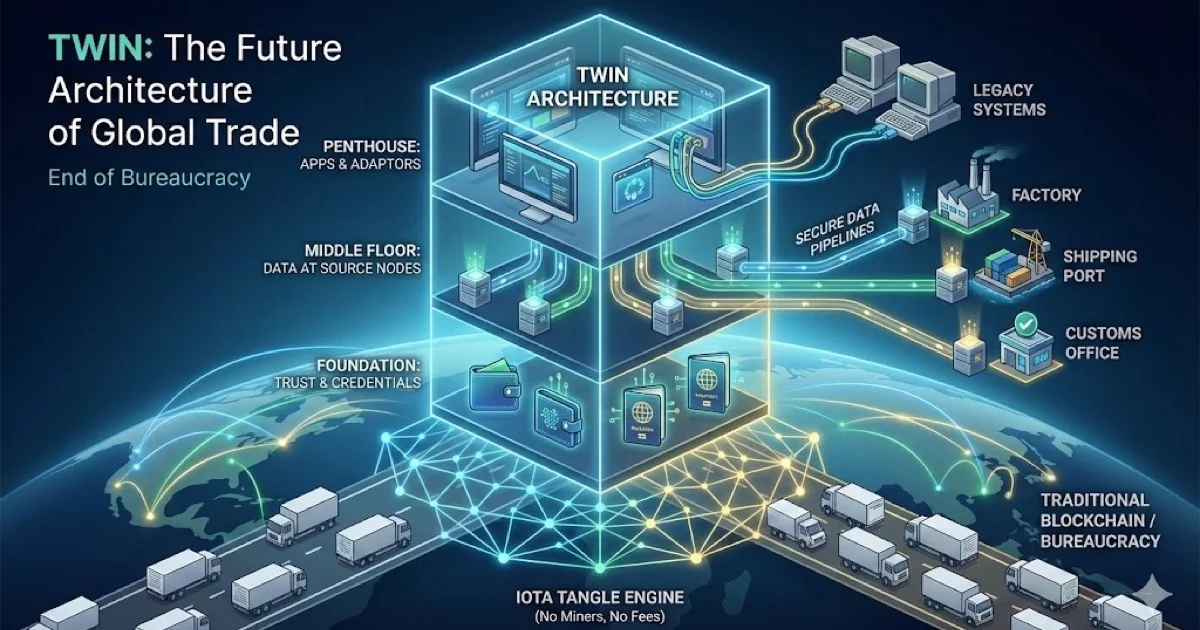

TWIN: the nervous system for global trade

The Trade Worldwide Information Network (TWIN) represents IOTA's flagship application for trade digitization. Built on the IOTA mainnet, it replaces paper-based systems with unified, verifiable digital infrastructure.

Here's what's actually happening onchain:

- Digital identities for every trade participant—exporters, importers, banks, customs, ports—with every transaction cryptographically signed and auditable

- Trade documents (certificates of origin, bills of lading, letters of credit) issued as verifiable credentials anchored to IOTA

- Shipment tracking via NFTs representing physical cargo movement

- AI-powered compliance scanning documents for consistency before they reach ports

- Tokenized assets—commodities, trade receivables, warehouse receipts—enabling instant access to DeFi-based trade finance

- Stablecoin settlements for near-instant cross-border payments at minimal cost

The TWIN Foundation launched in May 2025, backed by the IOTA Foundation, TradeMark Africa, World Economic Forum, Tony Blair Institute, the Institute of Export & International Trade, and the Global Alliance for Trade Facilitation.

This isn't a tech demo. It's production infrastructure.

Adoption is already live

Kenya's single-window customs platform (KenTrade) has fully integrated with IOTA. Traders already access digitized trade documents through the network. The UK Cabinet Office's Border Strategy team piloted TWIN for UK-EU freight—tracking over 2,000 poultry consignments from Poland to the UK throughout 2024-2025.

Results from early deployments:

| Metric | Impact |

|---|---|

| Transaction costs | Down 80% |

| Cross-border processing efficiency | Up 96% |

| SME participation | Up 35% |

| Document delays | Reduced from weeks to minutes |

Over the next 12 months, pilots launch in 10+ additional countries across Africa, Europe, Southeast Asia, and North America. By 2030, the projection is 30+ countries operating on the network.

Each country that joins expands network effects. If your trading partner uses TWIN, you have incentive to use TWIN. This creates the same adoption dynamics that made the internet essential—not because anyone mandated it, but because being disconnected meant being left behind.

We've covered how TWIN is deconstructing global trade bureaucracy and IOTA's role in Africa's digital trade revolution in previous analyses.

The $10 trillion unlock

The World Economic Forum estimates that TWIN could reduce global trade costs by 25%. Even a 5% efficiency gain across $32 trillion in commerce unlocks hundreds of billions in economic value.

But the real opportunity extends beyond efficiency. Consider the tokenization potential:

| Market | Annual Value |

|---|---|

| Global commodities | $20+ trillion |

| Critical minerals (by 2030) | $16 trillion cumulative |

| Trade receivables | $40-50 trillion outstanding |

| Trade finance gap | $2.5-3.5 trillion |

IOTA's competitive moat: the trade documents and shipment data live on its network. This positions IOTA uniquely for tokenizing the underlying physical assets. When you've already digitized the bill of lading, tokenizing the cargo it represents is a natural extension.

How $IOTA captures value

The token isn't a speculative asset. It's the mechanism that makes the infrastructure work.

Decentralization guarantee: Validators are elected by token holders. The more value staked, the more resilient and secure the network becomes. No single party can control or influence the system—exactly what governments require when adopting shared global infrastructure.

Staking rewards: Token holders secure the network and earn ~11% APY for doing so. Track your position with the Staking Tracker and model long-term growth with the Compounding Calculator.

Transaction fees: All onchain activity—transactions, smart contracts, tokenization—requires $IOTA paid and burned as fees.

Storage deposits: Creating digital assets (tokenized shipments, trade documents) requires locking IOTA as collateral. As long as assets remain digitized, those tokens stay out of circulation.

DeFi utility: Tokenized trade receivables and commodities become collateral in lending protocols, liquidity for stablecoins, and yield-bearing assets in structured products.

The economic model is deflationary by design: more usage creates more scarcity.

The partnership advantage

Individual partnerships aren't news in crypto. Everyone has "partnerships." What matters is whether those relationships produce actual adoption.

IOTA's coalition for trade digitization includes:

- Tony Blair Institute: On-the-ground programs with African governments, co-authored the landmark paper introducing TWIN

- TradeMark Africa: Deep expertise in customs modernization across Kenya, Rwanda, and the continent

- World Economic Forum: Global convener and validator, signed collaboration agreement at WTO MC13

- Institute of Export & International Trade: UK trade expertise, bridging technology and practitioner needs

- Global Alliance for Trade Facilitation: Connection to parallel initiatives and development financing

- GLEIF: Memorandum of Understanding to bring global business identifiers onchain

These aren't announcements. They're the organizations actively deploying IOTA infrastructure.

What this means for stakers

Network effects in trade create network effects in staking value.

Every country joining TWIN adds transaction volume. Each tokenized shipment consumes IOTA through fees and storage deposits. Rising institutional adoption increases demand for the token that secures the infrastructure.

The flywheel is straightforward:

- More countries adopt TWIN

- More trade documents and assets go onchain

- More transaction fees burned, more tokens locked

- Network becomes more valuable and more secure

- More countries have incentive to join

Current network metrics (December 2025):

| Metric | Value |

|---|---|

| Average staking APY | ~11-12% |

| Total staked | 2.3+ billion IOTA |

| Active validators | 70+ |

The endgame

IOTA isn't building another blockchain. It's building the trust layer for how trillions in value will move in the digital age.

The partnerships are in place. The technology is proven. The regulatory frameworks exist. And adoption is happening—not in press releases, but in actual customs systems processing actual shipments.

When millions of companies need to prove the authenticity of their goods, verify their trading partners, or access instant trade financing, they won't care about blockchain tribalism. They'll use what their governments trust, their banks accept, and their trading partners are already using.

After a decade of building, IOTA is positioned to become as essential to global trade as container ships, GPS, or the internet itself.

The stakers who understood this early are already earning rewards on the infrastructure that will power the next generation of global commerce.

Next steps

- Estimate your potential rewards with the APY Calculator

- Track your validator performance in the Staking Tracker

- Model compound growth scenarios with the Compounding Calculator

- Common questions? See the FAQ

Sources

Written by IOTA Staking Team

Expert in IOTA staking, blockchain technology, and DeFi strategies. Providing actionable insights to help you maximize your staking rewards.

Related Articles

Why IOTA's Bold Trade Focus Could Redefine Staking Returns

IOTA's $35T trade integration plan isn't just hype. Discover how it could unlock new staking rewards and reshape your portfolio strategy.

An Open Letter from an IOTA OG: We Didn't Just Survive – We Won

A retrospective on holding IOTA from 2017 to today, the transition to real-world adoption, and why staking is the victory lap.

Is This the End of Global Trade Bureaucracy? Deconstructing TWIN

TWIN proposes a Digital Public Infrastructure to revolutionize global supply chains. Here's how it works across three architectural levels—from apps to data services to trust framework.